Optimizing Customer Loyalty

Swiss Health Insurance

October 2024

Swiss health insurers face numerous challenges within the Swiss healthcare sector. Commercial Excellence is therefore crucial, as it focuses on optimizing all commercial activities to thrive in a highly competitive market, offering customers the best experience while operating efficiently and effectively.

In the Swiss healthcare system, insurers are confronted with various difficulties. Rising healthcare costs lead to ever increasing premiums, causing more people to regularly switch their basic insurance. Additionally, the highly regulated environment, driven by the directives of the Federal Office of Public Health (BAG) and the Swiss Financial Market Supervisory Authority (FINMA), limits room for product development and requires creative solutions. The sales landscape is also changing, forcing insurers to develop new approaches, identify suitable channels, and build partnerships. At the same time, digitalization raises customer expectations for services and experiences, with increasingly diverse needs. Overall, the scope of action for health insurers is significantly limited, and the industry is in the midst of a profound transformation due to these challenges.

To succeed in this competitive market, health insurers must secure a smart and sustainable competitive advantage. They can achieve this by driving Commercial Excellence.

Commercial Excellence

Commercial Excellence refers to the comprehensive optimization and integration of all commercial activities within a company—from sales and marketing to product development and customer service. The goal is to break down internal silos, streamline and evolve processes, and effectively identify the right customers, craft tailored value propositions, and enhance the sales process. Ultimately, Commercial Excellence leads to sustainable growth, increased profitability, and outstanding customer experiences. This ensures long-term competitiveness and market leadership.

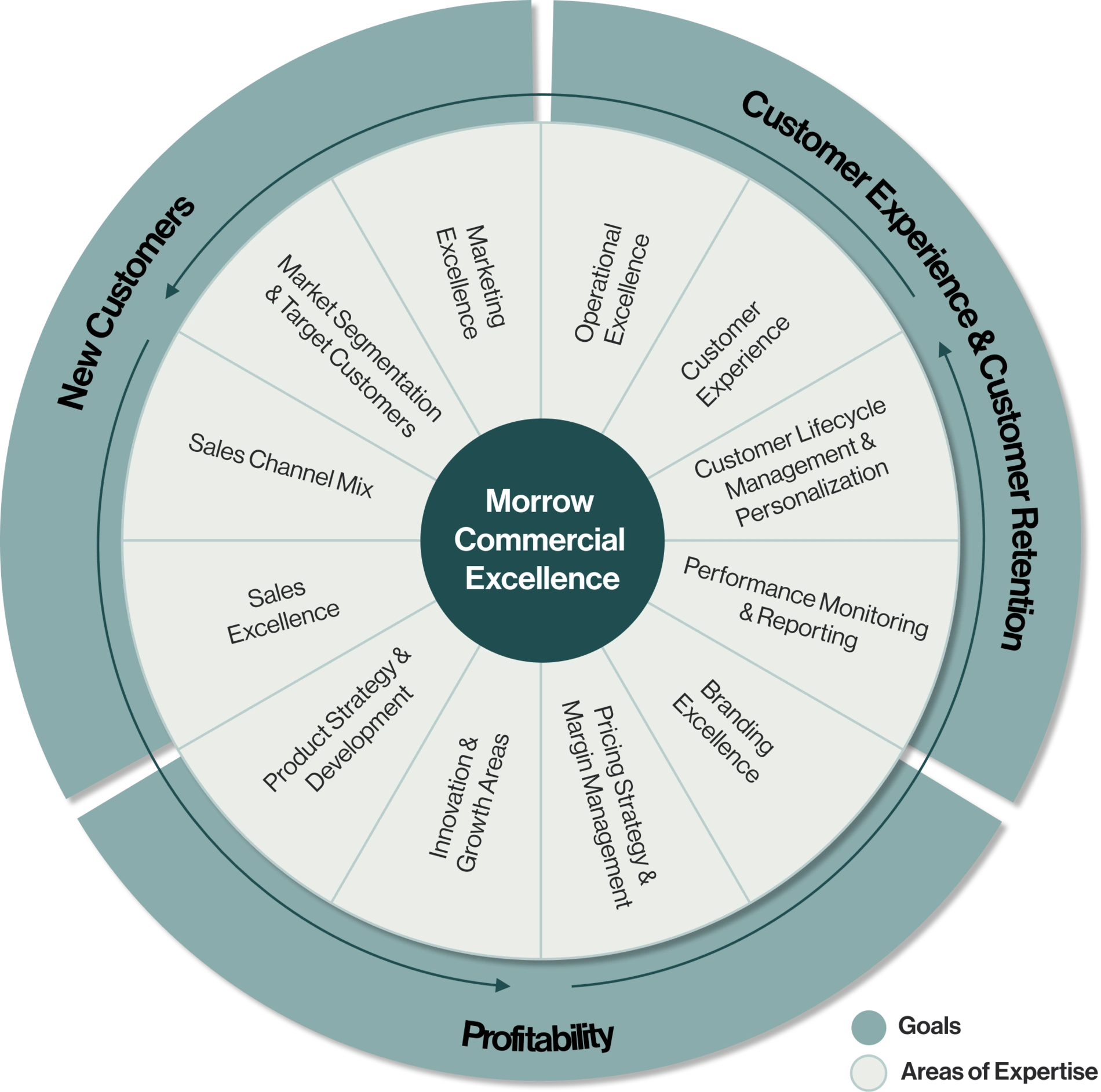

To achieve Commercial Excellence, health insurers must build competencies in twelve key areas, develop clear strategies, and execute them effectively. The three overarching goals of Commercial Excellence—growth, improved customer experiences, and higher profitability—are achieved through the integration of these competencies, as summarized in the «Commercial Excellence Wheel».

As the name suggests, Commercial Excellence is not a one-time project but an ongoing process that requires a clear, data-driven Commercial Strategy that is continuously optimized and adapted to market changes.

A company that excels in Commercial Excellence demonstrates superior capabilities in all twelve areas. Through exceptional performance in selected areas, it surpasses its competitors and gains a valuable competitive edge.

For each goal, health insurers face various questions that must be answered through the integrated application of skills from the twelve key areas of Commercial Excellence.

To attract new customers in a highly competitive market, health insurers must clearly understand the different customer segments, offer a product portfolio with optimal product-market fit, and use the right mix of sales channels. The sales process should be efficient, from the first marketing interaction to closing the deal. Silos between marketing, sales, customer service, and product development must be dismantled, and an integrated strategy implemented, where all departments work closely together.

Key questions include:

We were tasked by one of the largest Swiss health insurers to realign its complex, partially unprofitable, and outdated VVG portfolio and develop a future-oriented portfolio strategy. The goal was to create a customer-focused, easy-to-understand, and profitable offering. The strategy and roadmap prioritized actions based on available resources, expected impact, and potential risks.

A health insurer commissioned us to segment the market based on customer needs and behaviors and to define strategic target customers. In an interdisciplinary project, we developed a customized segmentation approach to clearly identify the company’s target customers and align its business activities in a targeted and coordinated manner.

To improve customer experience, enhance service quality, and reduce cancellations, it is essential to take a holistic view of the customer journey throughout the entire customer lifecycle—from the insurance product purchase, to claims processing, customer interactions, and even potential cancellations. Data-driven insights into customer behavior, expectations, and needs are crucial for providing personalized and relevant customer experiences, detecting patterns early, and implementing proactive retention measures.

Key questions include:

Our client was losing millions in premium volume annually due to cancellations. Together with data analysts and the actuarial team, we analyzed the root causes of product cancellations. In close collaboration with management, measures were prioritized and implemented within the teams to sustainably reduce the cancellation rate.

A client commissioned us to develop a functional strategy for customer service and to optimize the department to respond to changing customer needs and rising customer expectations. A target operating model was used to optimize processes, automate them with AI and improve the customer experience.

Although margins for health insurances are highly regulated, it remains important to increase efficiency through process optimizations and automation and reduce administrative costs. Additionally, products must be developed intelligently and in compliance with regulatory requirements, while unprofitable customers need to be further developed in a targeted manner. Diversifying into related health services and partnerships provides an opportunity to expand the business beyond the core. All relevant processes and customer interactions must be thoroughly analyzed, evaluated, and optimized—through avoiding unnecessary processes, automating using AI, or through optimization.

Key questions include:

We were tasked with optimizing existing sales channels and customer relationships to achieve the desired growth targets. Our assignment involved identifying and evaluating quickly implementable measures in the areas of customers, sales channels, and processes. The focus was on leveraging existing potential to achieve short-term success. Together with management, the measures were prioritized based on their impact on growth objectives and then implemented swiftly and efficiently within the respective teams.

To align the business model for the future and stay ahead of emerging trends, SOLIDA tasked us with developing a continuous trend monitoring system. New digital business models, products, services, and trends are regularly screened and systematically evaluated.

Depending on the company’s initial situation, strategic objectives, resources, and dependencies, different areas must be addressed. This allows the process toward Commercial Excellence to be tailored individually, with the goal of unlocking the greatest potential and gradually positioning the company for the future.

Our support covers various stages on the path to Commercial Excellence:

Together with our clients, we develop a comprehensive Commercial Strategy, considering ambitions, company strategy, and competition. We analyze the status quo across the twelve areas of our Commercial Excellence Wheel and identify the focus areas for achieving set goals. Based on this, we derive the implementation measures and prioritize them on a roadmap.

We support the development and implementation of strategies for predefined goals across all twelve competency areas. For example, we create an applied strategy for acquiring new customers.

We develop an implementation-oriented strategy for a specific area (e.g., product development). We consider all dependencies and interactions with other competencies and develop data-driven measures that contribute to all objectives.

Zu unserem Commercial Excellence Angebot